Insurance Billing & Accounting

What Should a Solid Billing System Include?

A robust billing system is more than just a tool—it’s a strategic asset designed to reduce complexity, drive efficiency, and attract business by making it easy for insureds and agents to work with you.

As the industry continues to evolve, modern carriers require more than just a billing tool—they need an intelligent, scalable, and highly automated system to ensure accuracy, compliance, and efficiency. Billing is no longer a back-office function—it directly affects customer satisfaction, operational profitability, and regulatory adherence. With advancements in cloud computing, AI-driven automation, and real-time analytics, the demand for a comprehensive solution that integrates seamlessly with policy administration and reporting is at an all-time high.

Comprehensive SaaS Billing System Built for Flexibility

BindExpress’ insurance billing software is engineered to meet the unique demands of modern carriers. Unlike many solutions, our solution is designed to:

✔ Enable Multi-Policy “Account Billing” – Consolidate billing when an insured buys a new product with just a few clicks… no endorsements are required.

✔ Support any type of billing, to any party – Direct, agency, third party, etc.

✔ Accept any payment method.

✔ Enhance Efficiency – reduce manual work-arounds and errors with intelligent automation.

API-First Architecture

BindExpress was built with API-first architecture, making it easy for insurers to integrate with accounting platforms, payment vendors, and external compliance databases.

✅ API Capabilities Added:

✔ Real-time transaction syncing across policy, billing, and claims.

✔ Automated invoice delivery based on premium finance agreements.

✔ Data exports in JSON, XML, and CSV formats for seamless third-party compatibility.

Features Designed for a Smarter Approach to Insurance Billing & Accounting

Billing solutions should no longer operate in silos. BindExpress integrates seamlessly with underwriting, policy administration, claims, and third-party accounting platforms to ensure a single source of truth across all transactions.

Modern carriers demand real-time data synchronization, ensuring that payment records, premium calculations, and policy changes instantly reflect across all systems. BindExpress achieves this by:

- Connecting with external data sources (payment processors, compliance databases, premium finance providers).

- Providing insurers and MGAs with self-service portals for direct billing access to reduce customer service bottlenecks and improve customer satisfaction.

Additional Features

✔ Automated Payment Processing

Schedule recurring premiums and apply discounts, late fees, or payment plans all with a few clicks.

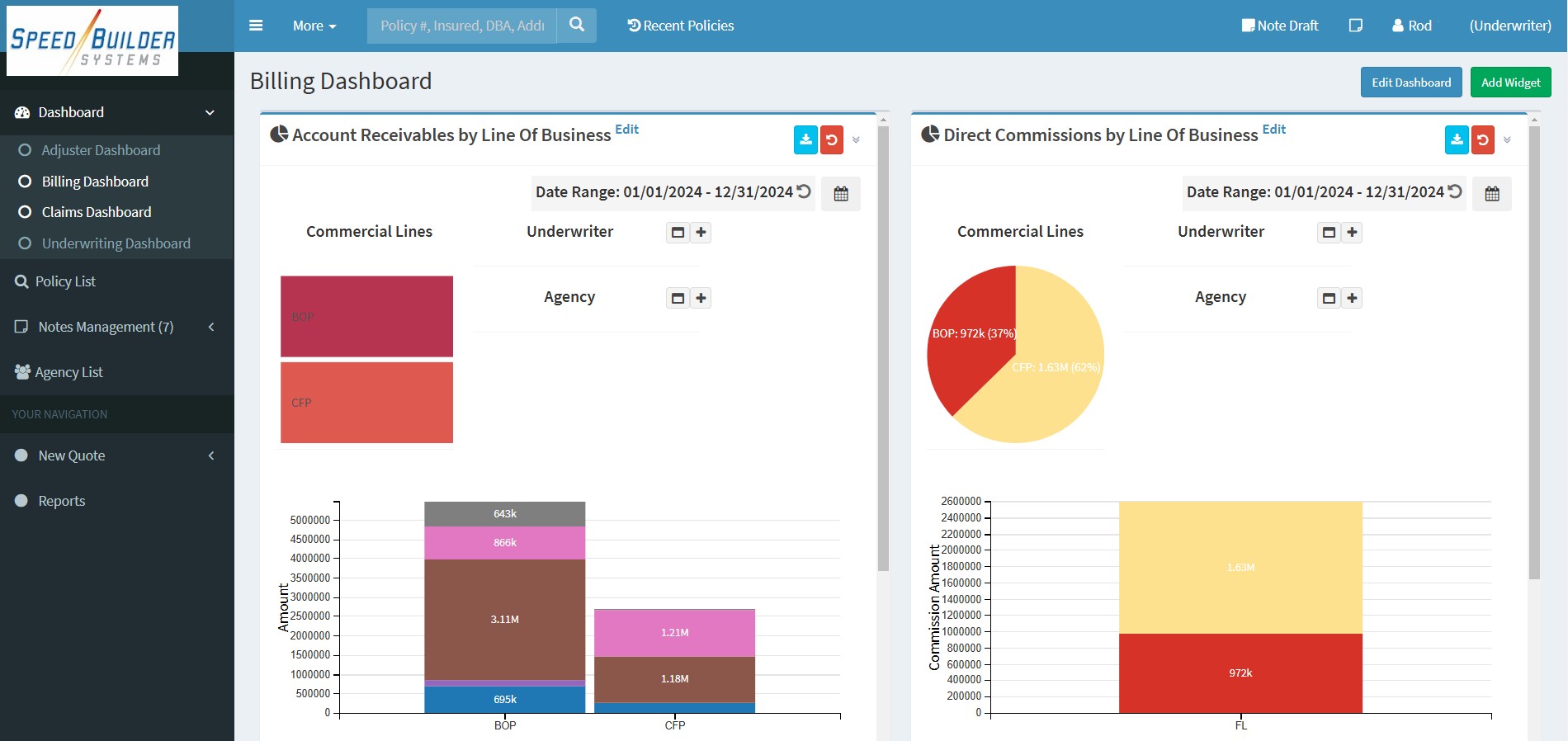

✔ Unified Dashboard

Monitor all billing activities, payment histories, and reconciliation statuses in one intuitive interface- — navigate to do almost any transaction (enter payment, apply write-off, etc.) directly from one dashboard! There’s no need to “scavenger hunt” across multiple menus/submenus to process your transaction.

✔ Compliance Guardrails

Automatically flag discrepancies and generate audit-ready reports for regulators.

✔ Multi-Channel Support

Enable self-service portals for policyholders to process payments via credit card, ACH, or digital wallets.

Challenges in Insurance Billing & How BindExpress Solves Them

Outdated Systems That Can’t Handle Modern Insurance Needs

Many insurers still use legacy billing systems that lack automation, making them slow and costly to maintain. Outdated software delays payments, increases processing errors, and frustrates policyholders.

Solution

✔ BindExpress replaces outdated legacy systems with a fully cloud-native solution—improving speed, automation, and cost efficiency.

✔ Seamless migration ensures minimal disruption to carrier operations.

Rigid Models That Don’t Support the Complexities of Insurance

The insurance business requires more than just standard invoicing—yet many billing platforms fail to support equity calculations, paid-basis issuance, or carrier-based taxes, surcharges, and assessments.

Solution

✔ BindExpress Supports agency bill, direct bill, premium finance, and hybrid models.

✔ Equity calculations prevent unnecessary cancellations due to missed payments.

Compliance & Regulatory Burdens

Billing compliance is complex and constantly changing. From statutory tax tracking to bordereau reporting, insurers must navigate a web of regulatory and other reporting requirements to avoid costly penalties.

Solution

✔ BindExpress automatically tracks and reports taxes, surcharges, and assessments for compliance.

✔ Audit-ready reports streamline carrier and regulatory filing and reduce administrative workload.

Why Choose BindExpress for Your SaaS Billing System?

1. Precision Meets Simplicity

BindExpress combines the depth of a billing solution with the agility of modern SaaS. It can replace outdated systems with a solution that cuts administrative workloads by 50%.

2. Built for Your Needs

From managing endorsements and cancellations to tracking commissions, BindExpress is tailored to the unique challenges of all lines of property and casualty insurance.

3. Future-Proof Updates

With frequent product updates, BindExpress ensures you always stay current, regardless of any customizations or modifications made for your business; there is no such thing as “retrofitting” of code with our Always-Current Architecture.

4. Cloud-Native, No Hassle

Access BindExpress securely from any device, with no downloads or server maintenance required. Your data is encrypted and backed up in real-time.

If you’re ready to future-proof your billing system with a modern, cost-effective, and robust solution, contact us today!

FAQs

What is insurance billing?

Insurance billing involves managing policyholder invoices, complex tracking of premium collections, and accurate accounting for carriers and MGA’s.

Can I purchase BindExpress Billing as a standalone product?

Yes! BindExpress # integrates with third-party systems or operates as a standalone SaaS billing system.

Is BindExpress cloud-based?

Absolutely. Access our platform securely from any browser, on any device.

How often do you deploy updates?

As often as you would like. We make a variety of system enhancements – about 50 per calendar quarter – and make them available whenever you want.

Transform Your Billing Operations Today

BindExpress insurance billing software is designed to simplify complexity, enhance accuracy, and drive efficiency. Ready to see how we can help you achieve more with less?

Key Benefits & Unique Features of BindExpress:

Handles the entire policy lifecycle—quoting, underwriting, policy issuance, invoicing, claims, and regulatory reporting—all within a single platform.

Tailor business rules, rate structures, and policy forms without complex coding.

A SaaS-based solution with flexible pricing and guaranteed response times.

Designed for ease of use, BX simplifies complex processes with transparent workflows and minimal data fields.

Empower agents and insureds with 24/7 access to policy information and transactions.

Connects easily with external systems through comprehensive APIs.

Regular updates ensure new functionalities, security enhancements, and performance improvements without downtime.

Ready to transform Your Insurance Operations with

SpeedBuilder Systems?

Streamline your policy administration and enhance operational efficiency. Discover how SpeedBuilder Systems can help you stay ahead in a competitive market.

Discover why top carriers trust BindExpress for their policy administration needs and see how we can improve operational efficiency.