Streamline Your Insurance Lifecycle with SpeedBuilder’s Claims Processing Software

What an Insurance Claims Processing Software Solution Should Look Like

Exceptional customer service and effective cost management hinge on consistent communication and timely claims processing. Achieving these goals requires a user-friendly, robust claims management software system.

SpeedBuilder Systems’s (SBS) BindExpress Claims (BXC) provides complete claims management for the life cycle of a claim – beginning with the first notice of loss (FNOL) and continuing through claim settlement and closure. Access to functionality, as defined by you, can be made available to employees and agents through BXC’s Configuration Toolkit.

BXC’s Fully Integrated Design Delivers Several Key Benefits:

- Every stakeholder—from adjusters to finance to compliance—has real-time access to the same data, reducing miscommunication and ensuring alignment.

- Claims move quickly from intake to final payment using seamless workflows and automated data handoffs, reducing delays and improving customer satisfaction.

- Centralized data eliminates duplicate entries and mismatched information, dramatically reducing the risk of manual errors.

- Reconciliation between departments is faster, cleaner, and less error-prone with financial and claims data in sync.

- There is less manual work, fewer system handoffs, and improved accuracy resulting in lower administrative overhead and fewer resource hours.

BXC Builds Trust with Customers When They Need You Most

Time and communication are the keys to profitability and successful customer relations when it comes to handling claims.

When customers call after an automobile accident or natural disaster, they expect immediate assistance – that’s why they buy insurance! Your adjusters need a claims management system that provides the tools necessary to respond to insureds quickly: immediate access to policy and coverage information, documentation, and payment processing.

Our BindExpress claims processing software optimizes customer assistance by offering:

- Automated workflows and real-time data access;

- Centralized documents, notes, and status updates so adjusters respond to customer questions confidently and accurately, without delays or guesswork;

- Instant coverage verification through a claims solution fully integrated with the policy module; and

- Systematic payment processing and check issuance for all claimants.

These tools allow you to make your promises to policyholders a reality.

It’s that simple.

Key Features and Tools

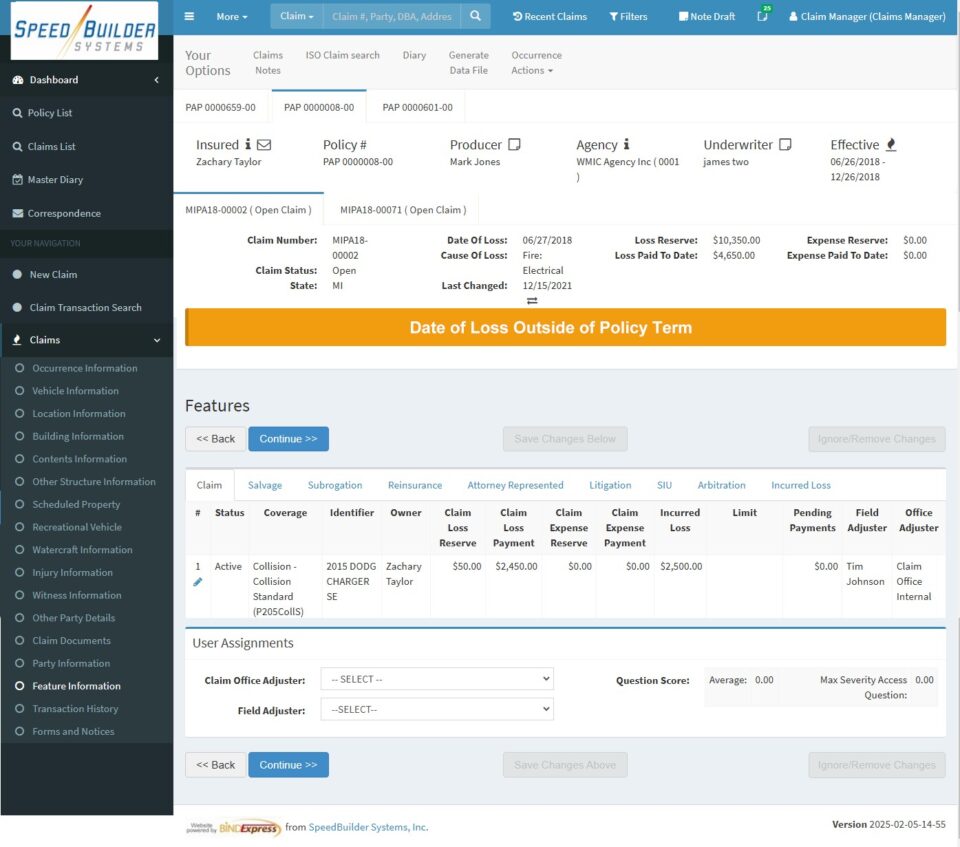

Whether you’re an insurance carrier handling everything in-house or a Managing General Agent (MGA) working with a claims TPA, BXC claims processing software flexes to fit how you do business. We designed our insurance software it for both veteran adjusters as well as digital natives, both of whom require an intuitive, easy-to-use interface.

The best part? You won’t need a seven-figure budget and an 18-month implementation timeline. Take what you need, leave what you don’t—BXC adapts to you, not vice versa.

Our BXC claims processing software provides practical tools that address the daily challenges your adjusters face while processing claims.

First Notice of Loss (FNOL) Reporting

BXC allows the capture of minimal, insurer defined loss information with which to begin the claim process. Key features of the FNOL module are:

- Ability to search for policy details using almost any search criteria (i.e. insured’s name, policy number, policy effective date, line of business, policy prefix, phone number, email, and address).

- Automatically verifies coverages based on loss date.

- Automatically populates FNOL data fields based on policy information.

- Ability to upload documents and/or images directly to the claim.

- Automatic adjuster assignment based on severity, peril/sub-peril, coverage issues, and adjuster skills.

- Client defined, dynamically generated claims questions based on coverage type and cause of loss.

- System generated claim numbers (in a format defined by the insurer) for easy accessibility.

- Activity and role-based worklists for adjusters, managers, and customer service representatives designed to encourage appropriate and timely actions.

- Ability to capture and store no coverage claims.

Claims Processing

BXC allows the conversion of the FNOL to a claim without data loss and captures all remaining information necessary for managing claim processing. Key features of the claim module are:

Automated Adjuster Assignment

- Automatic adjuster assignment based on severity, peril/sub-peril, coverage issues, and adjuster skills.

- Round-Robin and work load distribution designed to accurately and evenly distribute work among claim adjusters and define the maximum number of assignments per user.

- Temporary removal of an adjuster from automatic assignment (“Round Robin”) using the calendar facility.

Automatic Initial Reserve per Coverage Type

- Automatic loss and expense reserve creation as a flat amount (defined by you) based on line of business, coverage, and policy prefix.

- Automatic salvage and subrogation reserve creation as a flat amount or percentage of loss paid (defined by you) based on line of business, coverage, and policy prefix..

- Customizable using the BX Configuration Tool so changes are quick and easy, with no IT intervention.

Coverage Verification with Automatic Hold

- Automatic identification of coverage rules that require further investigation (i.e. excluded driver on policy, loss date within a defined number of days of the policy effective date).

- Automatic suspension of financial transactions on the claim until approved by an authorized user.

- Automatic verification of policy limits against reserve amounts.

Comprehensive Document Management

- Attachment functionality for organizing, retaining, and cataloging all claim documentation such as photographs, depositions, and estimates in a variety of formats (pdf, doc, docx, txt, html, zip, jpeg, jpg, xls, xlsx, wav, and csv).

- User initiated correspondence for claim specific letters and communication.

- Automatic correspondence generation based on pre-defined parameters such claim activity (i.e. Acknowledgement Letter).

- On-demand printing and email functionality of all claim documents.

Automated Status Notifications

- Automated and manual text messaging options available in both English and Spanish.

- Extensive diary and notes functionality, including automatically generated diaries (as defined by the insurer).

- Ability to set diaries for other adjusters and managers.

- Systematic note creation for providing a permanent transaction history for every claim, including user identification and creation time.

- Ability to refer notes to a role or specific user.

Integrated Payment Processing

- Payment capabilities includinginclude check issuance and EFT processing directly from the claims platform.

- Automatic inclusion of the policy deductible on the payment transaction screen.

- Bulk check and invoicing capability.

- Systematic check creation including creation of scannable MICR line.

- Ability to reverse claim payments and automatically recalculate reserve amounts.

- AutomatedBoth automated and user-driven claim closure.

- Automatic policy notification of open claim.

- Ability to automatically display potential, additional payees based on policy information (i.e. mortgagee, additional insured, lienholder).

- Ability to add additional parties, such as attorneys, vendors, and repair shops through the Configuration Toolkit for use on various screens.

- Enhanced customer satisfaction

And the best part? You don’t need an army of developers. Most customizations happen through simple configurations, not complex coding.

BXC in the Cloud

BindExpress is fully cloud capable.

The claims management software’s web-based architecture means your agents can access it from anywhere—no more VPN headaches or calls to IT when working remotely. We’ve implemented cloud deployments for everyone from lean, operational startups to established carriers retiring aging, on-premises legacy systems.

This SaaS, cloud-based approach also allows us to update the system seamlessly, behind the scenes. For MGAs and TPAs, cloud deployment allows business partners to access exactly what they need without compromising data security.

Ready to Transform Your Insurance Operations?

Our BindExpress Suite claims processing software delivers what matters—modular components, cloud capability, and practical tools built by industry veterans who understand your challenges.

Contact us today for a demonstration tailored to your specific needs. Your entire team—from adjusters to your CFO—will thank you.

FAQs

Is BindXpress Claims processing system cloudbased?

Yes, BindExpress’s claims processing system is cloudbased, so clients can use it from anywhere in the world with internet access. Field adjusters can enter pertinent claim data directly into BXC from any phone or tablet and attach photographs, recorded statements from claimants, and other documentation directly to the claim – improving response times to insureds and streamlining claim handling.

Does BXC integrate well with other softwares and tools?

Yes, BindExpress is integrated with over thirty (30) third-party vendors including those for claim search, fraud detection, and statistical reporting. Garages, attorneys, and payment vendors are also integrated with BXC.

Does claims software provide insights and analytics on the claims lifecycle and FNOL?

BindExpress’s claim management software offers insights and analytics using “dashboard” – graphical views of key data. Adjusters and managers can configure the dashboards themselves, displaying any selection of dimension groups, called “Widgets.” Dashboards let executives and managers analyze as much, or as little, of the claims data needed for assessing risk.

Common dashboard configurations include

- Outstanding Claims by Quarter,

- Outstanding Claims by Line of Business,

- Outstanding Claims by Cause of Loss, and,

- Outstanding Claims by Adjuster

– just to name a few. All dashboards are available by date range.

Speak to an Expert About Our Claims Software

If you are looking for an easier way to improve the productivity of your claims department and provide state-of-the-art claims service, contact us at SpeedBuilder Systems. You’ll find that our decades of experience in best claims practices have been successfully incorporated into the BindExpress Claims System.

Get in touch to learn more today.